“Transformation is an ongoing process that tends to appear ordinary, when, in fact, something extraordinary is taking place.” – Suzy Ross

In pursuit of this extraordinary, whom today can risk being left behind in this booming digital era? As an organization, you need to ask yourself what solutions or applications can be used to make your operations effective and customer service more responsive. Organization that are not making this question an essential part of their strategies are either being left behind or are slow to adopt digital transformation, leaving a severe gap in their product lifecycle evolution – mainly in the way they change, innovate, and reinvent. As pundits rightly point out, the late majority of adopters would need a revolution and not an evolution, so to speak.

What exactly is this much-touted digital transformation? It is, for a company, the process that helps in modifying the business processes, practices, and culture to stay relevant, compete and win in the digital age. Digital Transformation, therefore, uses technology to help the company in redefining various verticals of the organization with an ultimate end of enhancing the users’ experience of the brand and thereby the emotional connection with the brand.

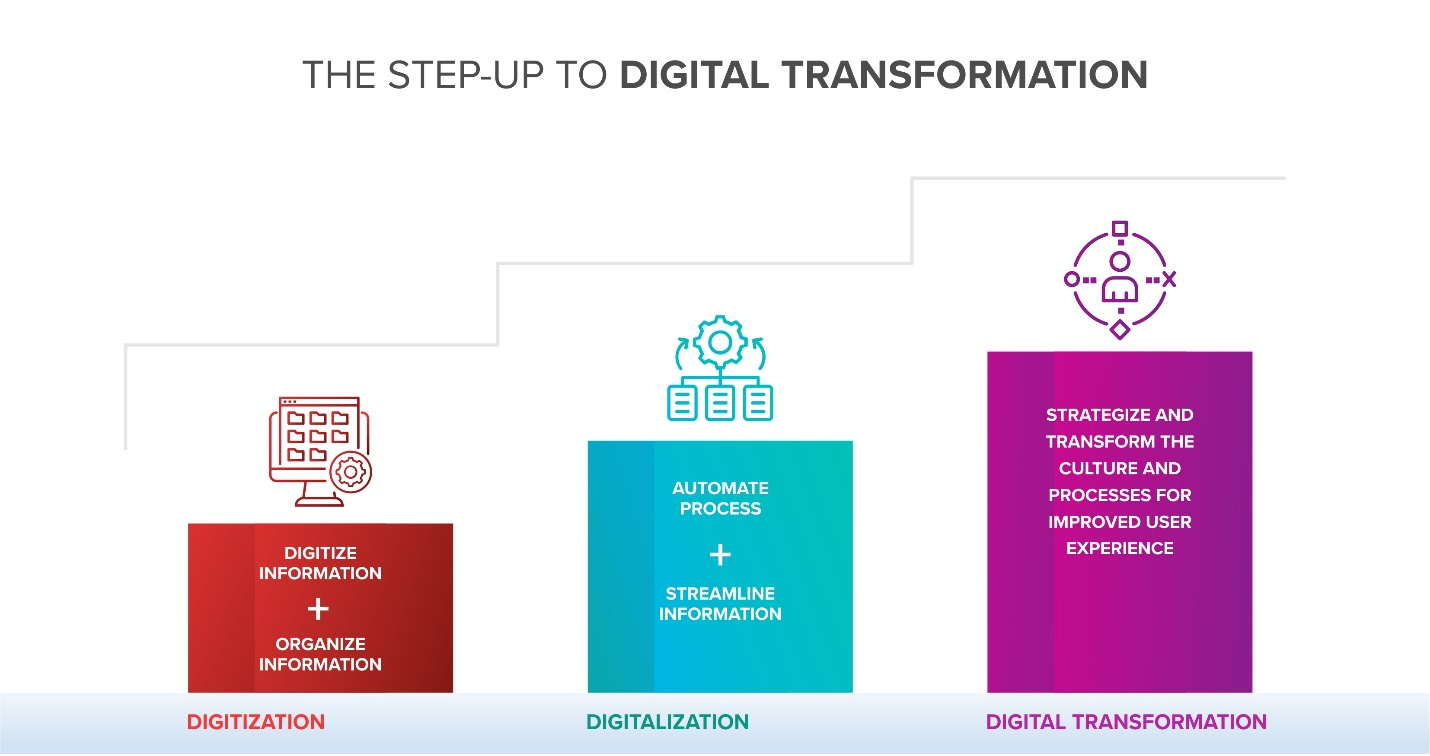

The term digital transformation is often confused with digitisation, i.e. making all the data available on digital platforms. Digitalisation, on the other hand, is when the manual processes are being carried out by automated or moderated digital processes, making them more efficient with a lower margin of error. While digitisation amplified the access to data and digitalisation significantly accelerated the speed of the process, the role of technology in these changes did not have a part to play in transforming the user experience significantly. This is the gap that digital transformation is here to cover.

Several industries are looking towards digital transformation to build a stronger connection with their customers through the experiences being provided and several digital platforms that keep companies and their consumers connected. Consumers spend much time on accessible digital platforms today, which open them up to many options and experiences. A digitally transformed company can demonstrate its readiness to cater to the present and future of consumption where it is always accessible and continuously agile in the delivery of experiences and consumer engagement.

Telecom companies proved to be experiential drivers and have maintained a lead on the revolutionary trend. They have facilitated the rapid growth in the use of smartphones and have been able to predict and create user experiences for consumers as per the developments in mobile technology and the increasing need for staying connected. Many telecom companies established OTT messaging services to develop the ability for businesses to transform their customer support systems to align with evolving customer behaviour. They are, therefore, able to continually innovate and create iterations of their services with outstanding agility.

The healthcare industry, too, has seen several developments that demonstrate the use of technology to design personalised experiences for the consumers too. Wearable technology has become extremely affordable and carries out different customizable functions from setting reminders for movement to gathering vital stats constantly. This information is continuously available to the user and the company that can now monitor the usability and usefulness of the product. A simple online search reveals the number of iterations that a smartwatch, for instance, has been through, thus demonstrating the role of digital transformation in the continual improvement of the user experience.

As a result, these are the companies that earn the trust of the consumers and gain their emotional investment which, in turn, leads to customer acquisition and greater satisfaction. Such is the digital experience that translates into profitable customers and the journey to becoming a sought-after brand. The Harvard Business Review also testifies that emotionally connected customers are 35% more likely to be loyal and profitable to companies than highly satisfied customers.

While some companies are quick to jump onto the bandwagon and benefit from it, there is a late majority who take some time before they make the leap. Research has helped identify a set of Digital DNA attributes. These attributes are aspects of organizational structure and culture that may make it more conducive or resistant to overhauls like the digital transformation. For instance, firms that are a part of the late majority tend to adopt digital transformation later on in the graph of the trend as they tend to be more cautious and hierarchical.

Digital Transformation is, therefore, an endeavour that is undertaken early on by companies that are less risk-averse and more eager to innovate continuously. Such attributes of the organization need to be cultivated across the board for all verticals to be able to work together in coherence and assume responsibilities and enormous changes that ensue digital transformation. While organization invest in exploration and research, they are also aware of their security boundaries which make them fail-safe. In addition to this, an organization is known to demonstrate greater readiness for digital transformation when the customers’ experiences are a priority across verticals.

Research done by leading companies brings out that the banking industry is yet to leverage the power of digital transformation fully. Banks are looking to go beyond digitalisation and transform into truly effective digital organization that enjoy the trust and emotional connection with their customers. With the bigger banks gradually transitioning into digital transformation, the late majority of the banks are likely to follow suit soon. The Bank of America, by virtue of having invested in digital transformation, currently receives more deposits from its mobile channel than it does from its branches. CEO Brian Moynihan recently reported an improvement in customer satisfaction as an outcome of the changes that the firm underwent as a part of digital transformation.

While banks and credit unions are making progress in their digital transformation efforts, there is still a great deal of work required as organization need to move beyond technology implementation to changing organizational culture around digital banking. Thus, initiatives need to move beyond IT to include the cross-functional collaboration required to compete against fintech and big tech offerings. It has been found that, in the area of innovation, a surprisingly small number of financial institutions (12%) consider themselves to be digital transformation ‘leaders’, with 34% considering themselves to be ‘fast followers’ and 55% stating they were either ‘mainstream players’ or ‘laggards’.

Labscove makes the journey of digital transformation smooth and efficient. It partners with clients to empathise with the needs of the consumers to be able to create what consumers want within a short time and with effective use of resources employing digital transformation. With a keen interest in the banking industry, we at Labscove employ a framework based on the user-centric design model to support companies to continually measure and iterate desirable user experiences to build trust and a strong bond and evolve as a brand.

When the transformation is taking place, it can seem ordinary, but once transformed, the benefits are extraordinary as the quote from Suzy Ross suggests. After reading this, if you feel as if you have missed the boat, fear not. One of the most common misconceptions is that your competitors are far ahead of you when it comes to digital transformation when, in fact, this is not true at all. As you embark or move forward on your transformation journey, Labscove is here to hold your hands and pull you forward in the right direction while you change the very definitions of your fundamental organizational interactions with employees and customers.